Funding

In the years leading up to the passage of the alcohol tax in 2020, Municipal and State services for violence prevention, homelessness, mental health, and public safety were at a breaking point. Community members demanded more.

By approving Proposition 13 in April 2020 and authorizing a 5% sales tax on retail purchases of alcoholic beverages, Anchorage voters made a commitment to provide a sustainable source of funding to respond to and prevent issues like substance misuse and untreated mental health issues.

The alcohol tax is making a difference in Anchorage.

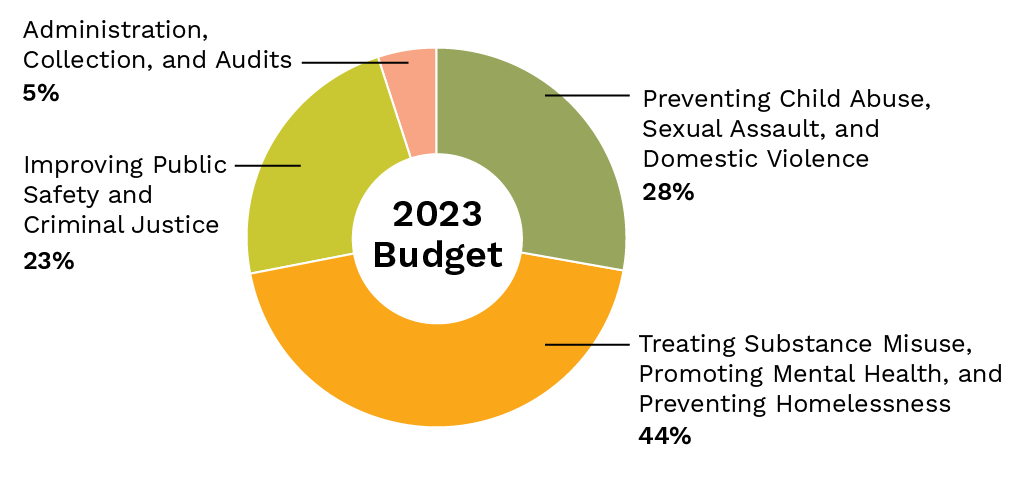

Revenue from the Anchorage alcohol tax is dedicated to:

Improving public safety

Preventing child abuse, sexual assault, and domestic violence

Treating substance misuse, promoting mental health, and preventing homelessness

Revenue is also dedicated to the cost of administration, collection and audit to the municipality to administer the tax

How will alcohol tax funds be spent this year?

Funds collected through the alcohol tax remain in the dedicated fund until spent.

How were alcohol tax funds spent previously?

Collecting and investing takes time. Unspent alcohol tax dollars roll over year after year and are always dedicated to investing upstream as voters intended.

How is the alcohol tax funding allocated?

The alcohol tax is a dedicated fund separate from general government funds. The budget is typically passed in November for the upcoming calendar year.